Pegasus Opera 3 Financials

Manage your cashflow effectively

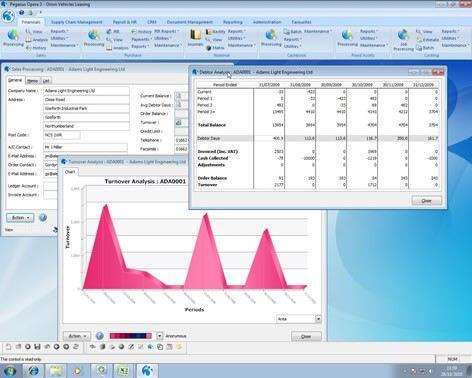

With Average Debtors Day calculation per customer, Opera 3 helps you manage aged debt, for a realistic revenue forecast.

Financials are the core to any business, whatever its size. With Opera 3 you can continually track your revenue and when it is due. Equally important, it reminds you who you owe money to and when it has to be paid. You’ll find the visibility of your cash flow invaluable for your profit generation. What’s more, reports from the Financials can be output directly to MS Excel.

The Retrospective Debtors report in the Sales Ledger produces a list of outstanding customer debts as at a date specified, aged according to the length of time the debt has been outstanding. For example, to rerun your Debtors report at 31 December 2010, you simply enter that date and the report calculates the debtors position at that time. The report can be printed and output to Excel.

Sales Ledger

Nominal Ledger includes analysis of Account, Type, Sub-type, Cost Centre plus two further user-definable levels as standard, giving you access and in-depth analysis at transaction level for the past 9 years.

Get management information and reports from Financials, Supply Chain and Payroll & HR. You can apply budgets at all four analysis levels, for current or future periods and years, with full percentage variance analysis and reporting. You can even easily change your year start date and maintain your data integrity.

The Nominal Ledger offers the Open Period Accounting functionality. Transactions can easily be posted from other applications such as Sales, Purchase, Cashbook, and Payroll into any open period of the last, current or next 3 financial years. Other applications post to the Nominal Ledger by either batch update or real-time transfer. Even mis-posted nominal journal entries can be reversed and rectified quickly and accurately.

Cashbook

With Cashbook you can post transactions directly from Financials, while the reconciliation function allows you to post unexpected entries, interrogate transactions and save incomplete reconciliations so you can finish them later.

” Cashbook for us has been a real game changer; it saves us an enormous amount of money and also means that we as a business can manage our risk ” Guy Atkins, Managing Director, Jo Bird

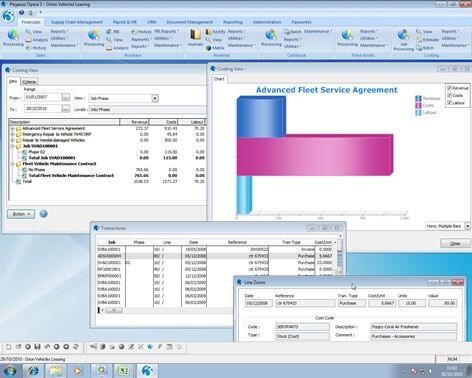

Costing

With Opera 3 Costing you can track job costs and revenues against budgets, and you can break down costs against a variety of categories including Labour, Contractor, Direct Expense, Stock and Interim Billing. Group jobs under contract headings or post against option phase, and stay easily in control. Any Timesheets raised for work on jobs can easily be transferred into Payroll to update employee records.

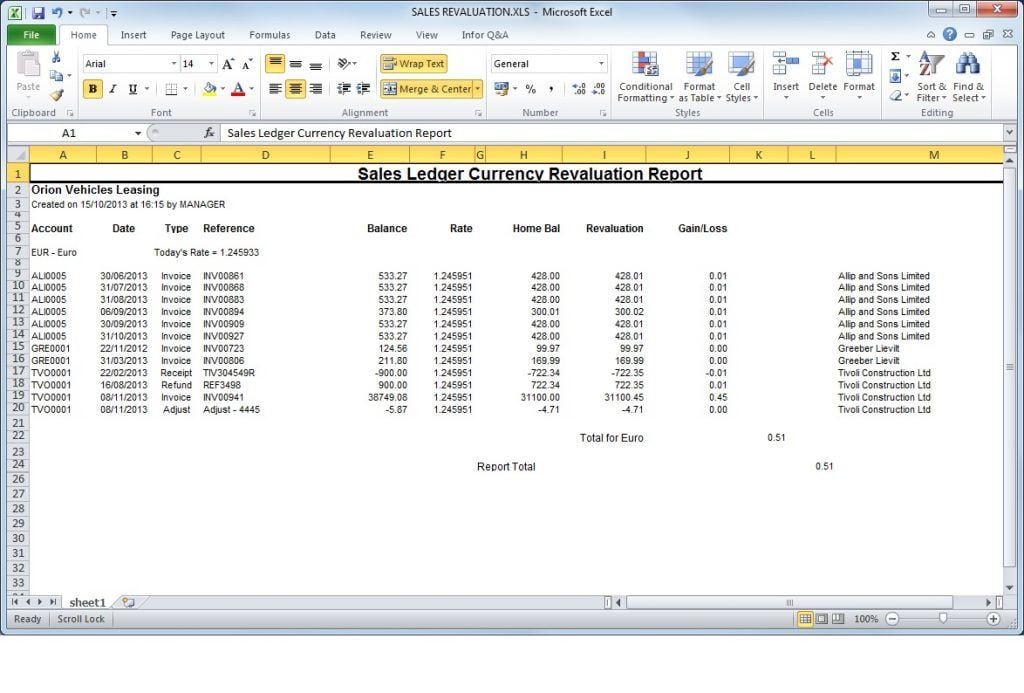

Multi Currency

Opera 3 handles unlimited currencies, exchange rates per transaction type and the calculation and recording of exchange rate fluctuations.

“As Ibonhart trades internationally, multi currency within Opera 3 is quite an important function for us as it allows us to reconcile on a daily basis with the up-do-date exchange rates” Sheila Austin, Accounts and Payroll Manager

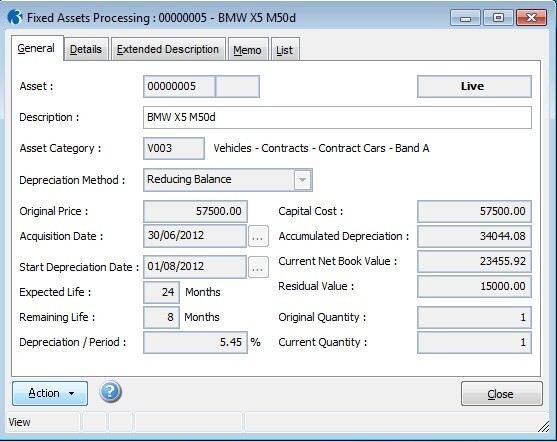

Fixed Assets

Keep track of your assets from the minute they become part of your company right until you dispose of them. Opera 3 Fixed Assets will track their depreciation rates and maintain the correct net book value for them throughout their life cycle. It caters for all types of assets, including Finance or Operating Lease and Hire Purchase or Lease Purchase assets. What’s more, the import routine makes it simple to import existing asset lists from a spreadsheet in bulk.

Purchase Ledger

With Opera 3, all your supplier transactions are thoroughly and securely managed from start to finish. Your cash flow is automated and improved with comprehensive cheque and BACS payment routines, e-mail remittances (individual or batched), and the calculation of creditor days.

It gives you dynamic access to purchase information across multiple periods and you can view the information you need in the manner you choose.

The integrated Purchase Invoice Register allows invoices and credit notes to be posted and remain in the register until they are authorised, giving you greater control over every document received. Payment workflow is enhanced though BACS and cheque payment routines combined with e-mail remittance. What’s more, with back-to-back processing to the Fixed Assets application, you can create an Asset record when posting an invoice to save re-keying information.

The Retrospective Creditors report in the Purchase Ledger produces a list of outstanding supplier debts as at a date specified, aged according to the length of time the debt has been outstanding. The report can be printed and output to Excel.

Nominal Ledger

Nominal Ledger includes analysis of Account, Type, Sub-type, Cost Centre plus two further user-definable levels as standard, giving you access and in-depth analysis at transaction level for the past 9 years.

Get management information and reports from Financials, Supply Chain and Payroll & HR. You can apply budgets at all four analysis levels, for current or future periods and years, with full percentage variance analysis and reporting. You can even easily change your year start date and maintain your data integrity.

The Nominal Ledger offers the Open Period Accounting functionality. Transactions can easily be posted from other applications such as Sales, Purchase, Cashbook, and Payroll into any open period of the last, current or next 3 financial years. Other applications post to the Nominal Ledger by either batch update or real-time transfer. Even mis-posted nominal journal entries can be reversed and rectified quickly and accurately.

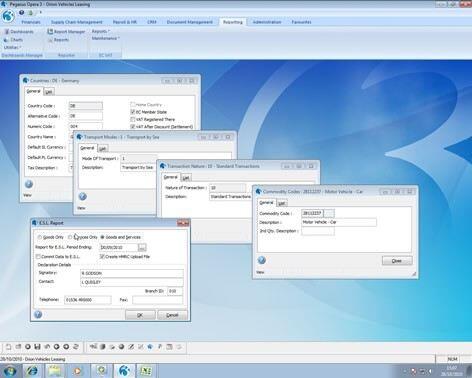

EC VAT

If you trade within the European Union there are complex VAT rules you have to comply with regarding the importing and exporting of goods. These rules can be hard to follow and failure to comply can result in financial penalties. To help you, these complex rules are automatically built into Opera 3 EC VAT to make it easier for you to trade in Europe.

You can define and maintain the information to produce the EC Sales List (ESL) and Supplementary Declarations (SD), including country codes, modes of transport, terms of delivery, commodity codes and nature of transaction codes for Intrastat purposes. The EC Sales List can also generate an XML upload file for submission via the HMRC website.

If you are using foreign currency accounts, appropriate VAT rate codes for EC sales and purchases can also be set up. This application will then collect the information needed to produce the returns for trading with EU member countries.

Want To Learn More? Book A Call With Us!

To find out more about Pegasus Software, and how TMB Group can support your business with Pegasus, book a call using our online diary below.